- 0.1 Why a Good Credit Score Matters

- 0.2 Understanding Credit Scores in South Africa and the USA

- 0.3 1. Pay Your Bills on Time, Every Time

- 0.4 2. Keep Your Credit Utilization Low

- 0.5 3. Build a Long Credit History

- 0.6 4. Diversify Your Credit Mix

- 0.7 5. Limit New Credit Applications

- 0.8 6. Regularly Review Your Credit Report

- 0.9 7. Settle Outstanding Debts and Avoid Collections

- 0.10 8. Consider Credit-Building Tools

- 0.11 How Long Does It Take to Build a Perfect Credit Score?

A strong credit score opens the door to financial opportunities, whether you’re applying for a loan, securing a mortgage, or obtaining favorable interest rates. For individuals in both South Africa and the United States, building and maintaining a high credit score is a critical step toward financial security and independence. However, the factors that influence credit scores in each country differ slightly, which means understanding the credit systems in both regions is essential for achieving the best possible score.

Why a Good Credit Score Matters

A high credit score demonstrates your ability to manage debt responsibly, making you a low-risk borrower in the eyes of lenders. In both the USA and South Africa, a good credit score can help you:

-

Qualify for higher credit limits

-

Secure lower interest rates on loans

-

Improve your chances of getting approved for rental properties

-

Obtain better insurance premiums

-

Gain access to better financial opportunities

With these benefits in mind, understanding how to build and maintain a perfect credit score becomes a valuable financial strategy.

Understanding Credit Scores in South Africa and the USA

Credit Score System in South Africa

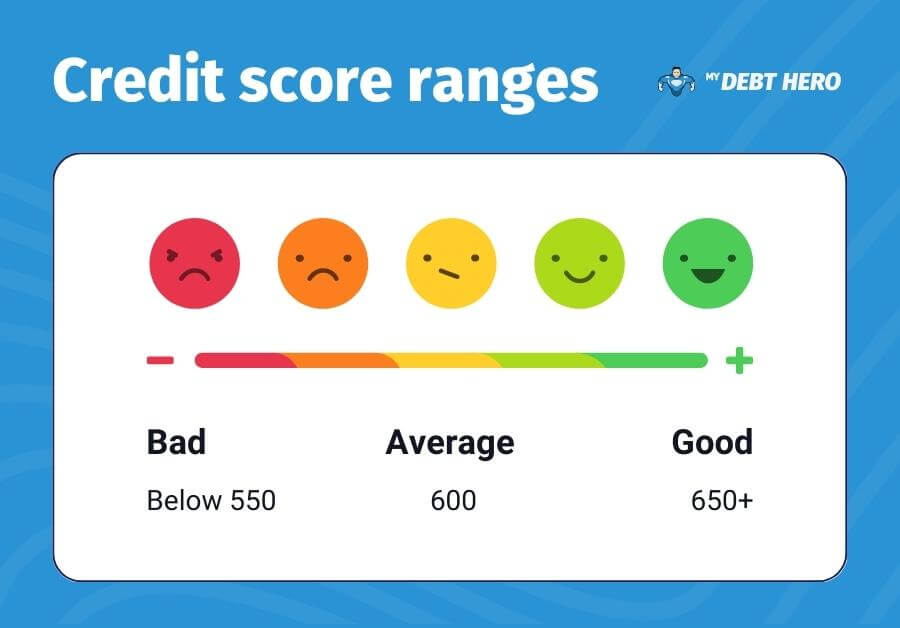

In South Africa, credit scores typically range from 300 to 850, with higher scores reflecting better creditworthiness. The major credit bureaus, including Experian, TransUnion, Compuscan, and XDS, calculate credit scores based on an individual’s credit history and financial behavior. A score above 650 is generally considered good, while scores above 750 are excellent.

Credit Score System in the USA

In the United States, credit scores also range from 300 to 850, with similar scoring categories. The three major credit bureaus—Experian, Equifax, and TransUnion—use the FICO scoring model to determine credit scores. A score above 700 is generally viewed as good, while scores above 800 are considered exceptional.

Despite these similarities, the factors that affect credit scores in each country vary slightly, making it important for individuals to understand the nuances of building a strong credit profile in both regions.

1. Pay Your Bills on Time, Every Time

Consistently paying your bills on time is the most important factor in maintaining a good credit score, whether you’re in South Africa or the USA. Payment history accounts for approximately 35% of your FICO score in the USA and has a similarly high impact on credit scores in South Africa. Late or missed payments can significantly damage your score, and the effects can linger for up to seven years.

To avoid late payments:

-

Set up automatic payments for recurring bills.

-

Use payment reminders to stay on track.

-

Pay at least the minimum amount due, even if you can’t afford the full balance.

In South Africa, late payments are reported to credit bureaus after 30 days, while in the USA, creditors typically report late payments after 30-60 days.

2. Keep Your Credit Utilization Low

Credit utilization refers to the percentage of your available credit that you’re using. A low credit utilization ratio signals that you’re using credit responsibly and not overly reliant on borrowed funds. In the USA, keeping your utilization below 30% of your credit limit is ideal, while South African lenders also prefer utilization rates under 30%.

To maintain low credit utilization:

-

Pay down credit card balances regularly.

-

Request a higher credit limit to reduce your utilization ratio.

-

Avoid maxing out your credit cards, even if you plan to pay off the balance.

3. Build a Long Credit History

Length of credit history plays a significant role in determining your credit score. In the USA, credit history accounts for 15% of your FICO score, while in South Africa, the duration of your credit relationships is also taken into account when calculating your score. A longer credit history demonstrates stability and responsible credit management.

To build a long and positive credit history:

-

Keep old credit accounts open, even if they’re not used frequently.

-

Use older credit cards occasionally to keep them active.

-

Avoid closing long-standing accounts unless absolutely necessary.

If you’re just starting out or rebuilding credit, consider opening a secured credit card or taking out a small credit-builder loan to establish a positive payment history.

4. Diversify Your Credit Mix

Having a healthy mix of credit accounts can positively impact your credit score. Credit mix accounts for 10% of your FICO score in the USA, while in South Africa, maintaining a balanced portfolio of credit types also demonstrates responsible credit management. A well-rounded credit profile includes:

-

Credit cards

-

Retail store accounts

-

Installment loans (such as auto loans or student loans)

-

Mortgages

To improve your credit mix:

-

Avoid applying for too many types of credit at once.

-

Consider adding a mix of credit products gradually over time.

5. Limit New Credit Applications

Applying for multiple credit accounts in a short period can hurt your credit score, as each application generates a hard inquiry on your credit report. In the USA, new credit inquiries account for 10% of your FICO score, while in South Africa, frequent applications for credit can signal financial distress and negatively impact your score.

To avoid lowering your score:

-

Apply for credit only when necessary.

-

Space out credit applications over several months.

-

Check your credit report for errors before applying to ensure that your profile is accurate.

6. Regularly Review Your Credit Report

Monitoring your credit report regularly helps you spot errors, identify fraudulent activity, and understand how your financial behavior impacts your score. Both South African and American credit bureaus allow individuals to request a free credit report once a year. Reviewing your report helps ensure that your credit profile remains accurate.

To check your credit report:

-

Request a free credit report annually from major credit bureaus.

-

Look for incorrect account details or errors that could be dragging down your score.

-

Dispute any inaccuracies with the relevant credit bureau to have them corrected.

7. Settle Outstanding Debts and Avoid Collections

Unpaid debts that go to collections can severely damage your credit score, whether you’re in South Africa or the USA. Collection accounts can remain on your credit report for seven years and make it challenging to qualify for loans or credit in the future.

To avoid collections:

-

Set up a payment plan with creditors if you’re unable to pay the full balance.

-

Prioritize paying off delinquent accounts.

-

Communicate with creditors to explore options for settling outstanding debts.

8. Consider Credit-Building Tools

For individuals with limited or poor credit history, utilizing credit-building tools can accelerate the process of establishing a strong score. In South Africa, credit-builder loans are available from financial institutions, while in the USA, secured credit cards and credit-builder loans help establish a positive credit history.

To build credit effectively:

-

Use a secured credit card responsibly by keeping balances low and paying on time.

-

Take out a small credit-builder loan and make timely payments.

How Long Does It Take to Build a Perfect Credit Score?

Building a perfect credit score doesn’t happen overnight. It typically takes years of consistent, responsible credit behavior to reach the highest score range. Individuals with limited credit history can expect to see improvements in their score within 6 to 12 months of practicing good credit habits. For those recovering from past mistakes, it may take 3 to 7 years to rebuild credit fully.

Achieving a perfect credit score in South Africa and the USA requires a combination of timely payments, responsible credit use, and ongoing vigilance. By consistently paying your bills on time, maintaining low credit utilization, diversifying your credit mix, and avoiding unnecessary credit inquiries, you can gradually build a strong credit profile. Taking proactive steps to monitor and improve your credit score ensures that you’ll have access to better financial opportunities and a secure future.